Varyante

Bitcoin vs gold: ETF flows point to early capital rotation signs

<p style="float:right; margin:0 0 10px 15px; width:240px;"><img src="https://images.cointelegraph.com/images/528_aHR0cHM6Ly9zMy5jb2ludGVsZWdyYXBoLmNvbS91cGxvYWRzLzIwMjUtMTIvMDE5YjY1ZGEtZTk2MC03ODFkLTk2OGEtZWZkMzQ1MTVhN2EwLmpwZw==.jpg" alt="Bitcoin vs gold: ETF flows point to early capital rotation signs" class="type:primaryImage"></p><p>Bitcoin ETF inflows have turned positive as gold ETFs see record outflows after a historic rally. Is capital beginning to rotate from gold to Bitcoin?</p>

Trump announces sanctions relief to ease oil prices, says Iran war to end ‘very soon’

President Donald Trump said the U.S. is waiving oil-related sanctions on certain countries in an effort to ease crude prices, as he estimated the war with Iran would end “very soon.”

Will Bitcoin follow oil’s historic surge and rally to $79K before the end of March?

Historical data shows that Bitcoin typically gains 20% within a month of major spikes in oil prices. Should traders prepare for a rally to $79,000?

The NFL’s Dolphins are paying a record $99.2 million to get a player off their team

Here’s why some NFL teams are giving their players, including Tua Tagovailoa, staggering amounts of money to stop playing for them.

Crypto-backed PAC spends $8.6M in Illinois races ahead of US midterms

The political action committee Fairshake continues to report spending on political candidates from its $193 million war chest, largely funded by crypto interest groups.

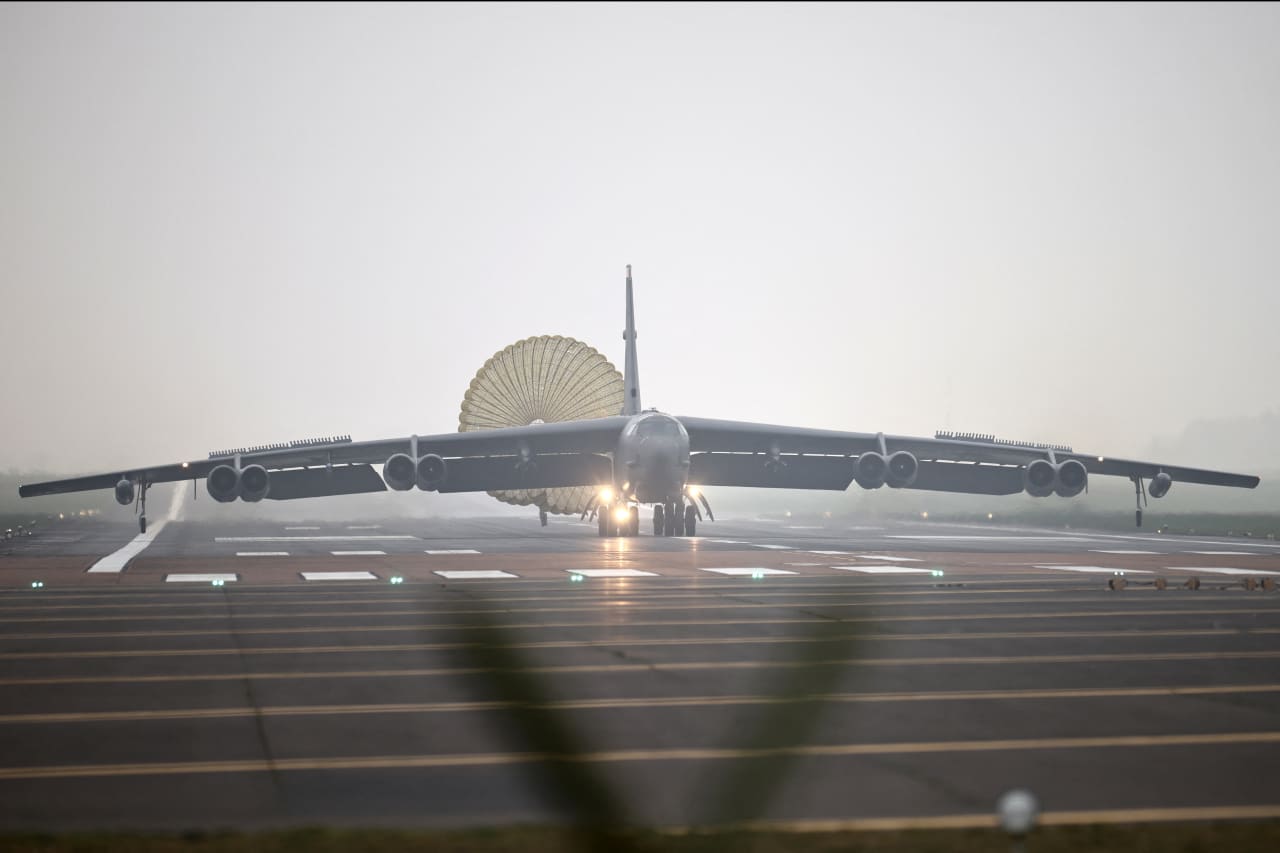

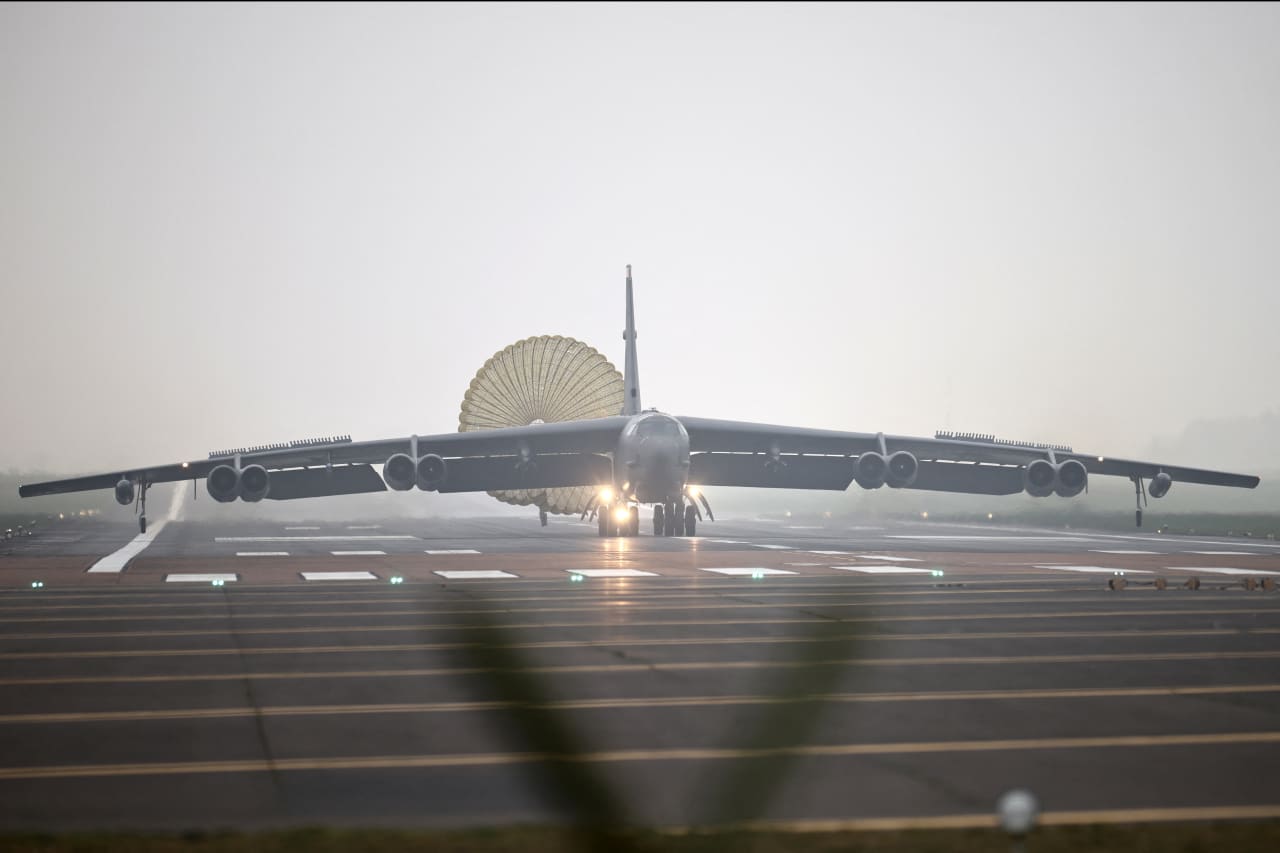

An already chaotic spring travel season is colliding with effects of Iran conflict

Americans who thought spring break would offer rest and relaxation after a tough winter may be in for a rude awakening.

Nasdaq links EU markets to Boerse Stuttgart's tokenized settlement venue

<p style="float:right; margin:0 0 10px 15px; width:240px;"><img src="https://images.cointelegraph.com/images/528_aHR0cHM6Ly9zMy5jb2ludGVsZWdyYXBoLmNvbS91cGxvYWRzLzIwMjYtMDMvMDE5Y2Q0NDAtNGViZC03MDIyLThkN2ItNDhiOGY3YjU4ZTA4LmpwZw==.jpg" alt="Nasdaq links EU markets to Boerse Stuttgart's tokenized settlement venue" class="type:primaryImage"></p><p>The partnership aims to reduce fragmentation in European capital markets by enabling blockchain-based settlement of tokenized securities.</p>

‘I am stuck in a low-income trap’: I’m a teacher and very good at my job. Will I ever earn six figures?

“My low salary requires me to have multiple other part-time jobs.”

‘I find this very worrying’: A friend lost her home. Why are foreclosures on the rise?

“She is wondering if she will ever get her $100,000 in equity back.”

Aon tests stablecoin payments for insurance premiums with Paxos, Coinbase

The insurance broker is piloting stablecoin payments for premiums using USDC and PYUSD, testing blockchain settlement rails for faster payments in global insurance markets.

Older workers embrace job hopping — and it’s good for their retirement prospects

Moving from job to job allows workers to trade up to higher-paying employers.

HPE’s stock rises as earnings benefit from two big AI trends

The company lifted its outlook for networking revenue and disclosed a big bump in orders for enterprise AI servers.

This biotech’s stock soared after a ‘polarizing’ FDA official is stepping down

Vinay Prasad, an official for the Food and Drug Administration, is reportedly stepping down, which is welcome news for biotech companies.

Wyoming Senator revives crypto tax exemption debate amid market structure talks

Cynthia Lummis continues to push pro-crypto policies in a market structure bill under consideration in the Senate, even as she prepares to leave Congress in January 2027.

Price predictions 3/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

<p style="float:right; margin:0 0 10px 15px; width:240px;"><img src="https://images.cointelegraph.com/images/528_aHR0cHM6Ly9zMy5jb2ludGVsZWdyYXBoLmNvbS91cGxvYWRzLzIwMjYtMDMvMDE5Y2QzYTYtOGI5ZS03NTFkLWEzZTMtNmI5YzVhYmI1Y2EyLmpwZw==.jpg" alt="Price predictions 3/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH" class="type:primaryImage"></p><p>Buyers were undeterred by surging oil prices, pushing Bitcoin near $69,500 and large-cap altcoins close to their overhead resistance levels.</p>

Blockchain.com expands into Ghana after 700% trading growth in Nigeria

<p style="float:right; margin:0 0 10px 15px; width:240px;"><img src="https://images.cointelegraph.com/images/528_aHR0cHM6Ly9zMy5jb2ludGVsZWdyYXBoLmNvbS91cGxvYWRzLzIwMjYtMDMvMDE5Y2QzNjAtOWJiYy03ZmFjLWEyZGYtNjJkNzUxYjY1ZTUwLmpwZw==.jpg" alt="Blockchain.com expands into Ghana after 700% trading growth in Nigeria" class="type:primaryImage"></p><p>The crypto brokerage said increasing demand across West Africa is driving its expansion as user activity grows across the Sub-Saharan region.</p>

Can you still mine Bitcoin on a PC in 2026? Here is the reality

Mining Bitcoin on a desktop in 2026 may sound simple, but is it profitable? Do rising network difficulty and energy costs mean the end of PCs as Bitcoin mining equipment?

Three energy stocks look like bargains as the Iran conflict drags on

Most of the 2026 gains in the S&P 500 energy sector came before the U.S. and Israel attacked Iran. Meanwhile, stock prices are pulling back in one corner of the oil and natural-gas industry.

This is what’s cutting into your pay raise — if you get a bump at all

Companies are responding to these higher costs by reducing wage increases

The stock market is still priced for ‘absolute chaos,’ but the worst-case scenario will be avoided, Nomura strategist predicts

Equities are likely to grind sideways but a full-on rout will probably not happen, disappointing those who have been betting on one, Charlie McElligott said.